Investopia 2023 was a highly anticipated event that brought together global leaders from across the investment ecosystem and various new economic sectors. This second edition of Investopia, taking place in the UAE’s capital Abu Dhabi, aimed to provide participants with a unique platform to explore new insights and investment trends resulting from a rapidly changing world, connect with like-minded global leaders, and identify promising investment opportunities in new economies and beyond.

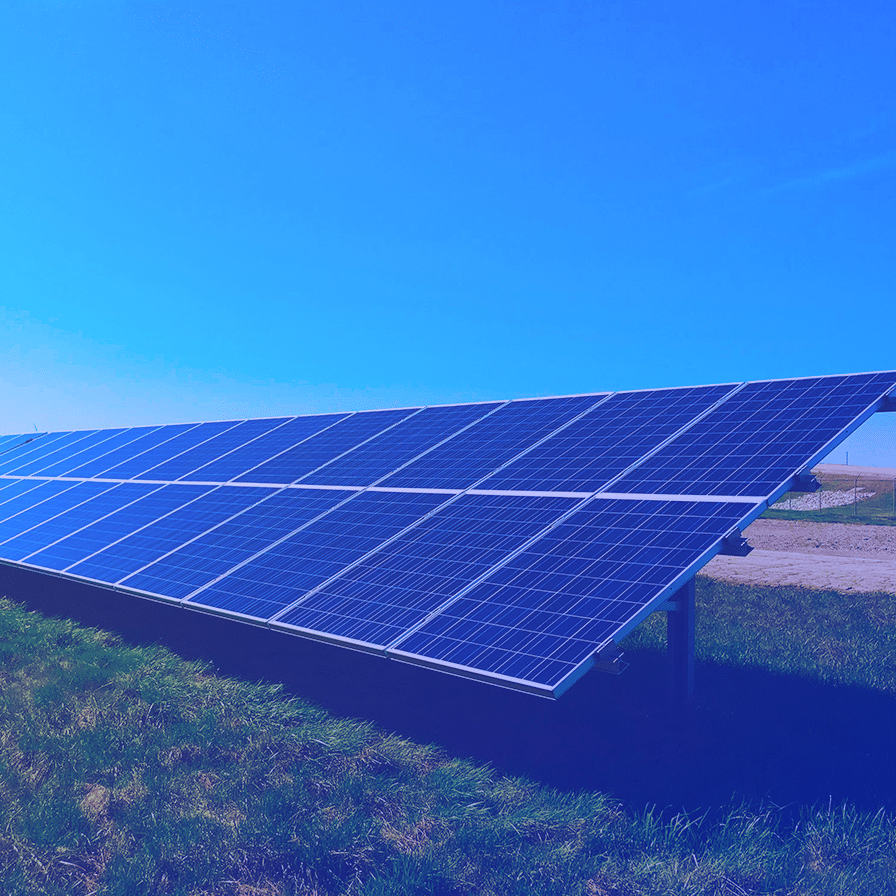

Organized under the theme “Envisioning Opportunities in Times of Change” in partnership with SALT, Investopia 2023 featured dynamic and engaging discussions revolving around three key areas: Envisioning Opportunities in Today’s Economy, The Future of the Wealth of Nations, and Growth Opportunities in times of Decarbonization.

Furthermore, building on its vision to create an investment community and marketplace for unique opportunities in new economies, Investopia 2023 saw the launch of the first edition of its “Venture Marketplace”. This marketplace brought together startups, entrepreneurs, and VCs, giving them the opportunity to present their success stories, form interesting dialogues specific to the startup space, and explain their investment strategies and interests for the near future.

In addition, Investopia 2023 featured a Capital Introduction activity that aimed to connect a global network of allocators with a diverse range of fund managers through innovative technology.

Finally, Investopia 2023 hosted a series of closed roundtables and investment meetings that brought together global financial and non-financial institution leaders to discuss areas of collaboration and investment opportunities.