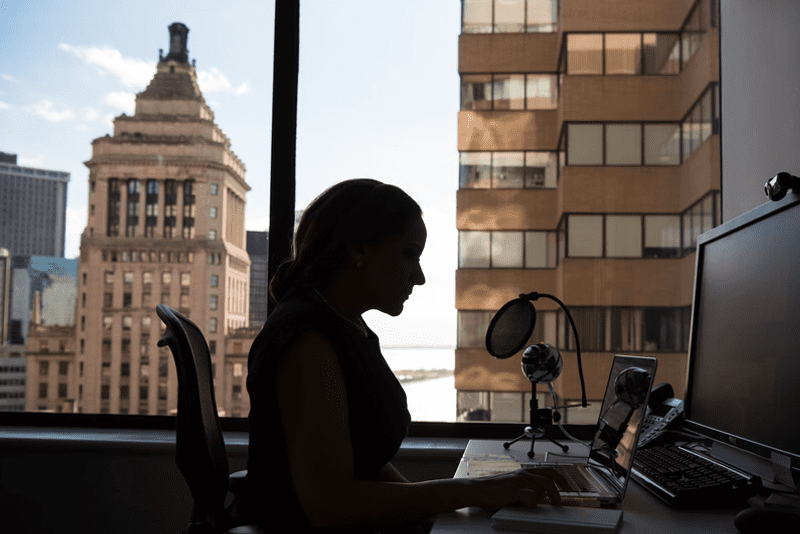

Session Speakers:

Huda Al-Lawati

Founder and CEO, Aliph Capital

Lindsey Taylor Wood

Founder and General Partner, The Helm

Nadine Benchaffai

Founder, Angel Investor

Share

Listen to this content

Key Takeaways

- The investment community should focus on good business practices rather than gender when investing in companies. Gender shouldn't be a factor in evaluating the success of a company.

- Women-led businesses perform better, and investors should recognize this by investing in them. There is a pipeline problem for women-led businesses, but it varies depending on region, growth stage, and industry.

- Women need to be more confident and ask for equity. They should be included in a company's leadership to improve performance.

- The debate is about what to call this and the narrative and the whole gender-related language can be tricky. The investment community should be open-minded and listen to people, no matter what group they “belong to”.

- Women with wealth are the single greatest lever for change to happen. The number one request from High-Net-Worth Women in the network is to have their funds managed by either a woman or a man/fund with good gender policies.

Investing in female-led businesses is crucial to building a more inclusive and diverse business landscape. The recent “Good Business” session, in partnership with The Helm, focused on the challenges that women face in raising funds for their businesses and the need for a shift in investor mindset toward gender-neutral investment. The session featured speakers Lindsey Taylor Wood, Founder, and General Partner at The Helm, Huda Al-Lawati, Founder and CEO of Aliph Capital, and Nadine Benchaffai, Founder of Angel Investor. It was moderated by Rachel Pether, Senior Advisor at the Sovereign Wealth Fund Institute.

The speakers discussed the challenges that women face in raising funds, highlighting the gender bias that exists in the investment industry. Women often receive less funding than men, despite starting fewer businesses. Nadine Benchaffai noted that women can sell themselves short and urged them to ask male colleagues what they should push for to receive a fair share.

Lindsey Taylor Wood argued that investors should invest in good businesses, regardless of gender, and the narrative must be reframed to focus on good business rather than gender. She cited a Harvard Business School study that showcased the difference between the questions men and women are asked in interviews. The speakers agreed that the hand-holding narrative toward women should stop as women-led businesses perform better.

Huda Al-Lawati emphasized the need for inclusivity and reputability in a company’s leadership, which leads to better performance. She urged the investment community to be open-minded and listen to people, regardless of the group they belong to. She also emphasized the importance of capital for women-led businesses, highlighting that women do not need special training but instead need more capital.

The speakers also discussed the lack of understanding of the femtech market among male investors, which results in missed opportunities for investment. They urged the investment community to be open-minded and listen to people, no matter what group they belong to.

The panelists concluded that to level the playing field, the investment community needs to be unbiased in their assessment and invest in female founders and female-led funds. Women with wealth were identified as the single greatest lever for change. High-Net-Worth Women in Lindsey Taylor Wood’s network requested that their funds be managed by either a woman or a man/fund with good gender policies.

Institutional investing was also identified as a critical factor in moving the needle, but policies and rules must be in place to set aside women founders indirectly. The speakers also discussed the need for more female investors, highlighting that females do not have the same gender bias as men, resulting in more opportunities for investment.

In conclusion, the “Good Business” session emphasized the need for inclusivity and unbiased assessment in the investment community to level the playing field for women-led businesses. By investing in good businesses, regardless of gender, and reframing the narrative to focus on good business, we can create a more diverse and inclusive business landscape.