Session Speakers:

Amir Farha

Founder, COTU Ventures

Dr. Tariq Bin Hendi

Senior Partner, Global Ventures

Stephan Heller

Founding Partner, AQVC

Share

Listen to this content

Key Takeaways

- Failure is inevitable in the world of VC, and it is essential to differentiate between good and bad failures.

- Education and knowledge sharing are crucial in the VC industry to help entrepreneurs and investors better navigate and understand the risks associated with investing.

- Founders must be willing to fail in small steps and pivot when necessary while hiring the right people from the beginning.

- The ecosystem plays a vital role in supporting entrepreneurs, and a cultural shift toward accepting failure is necessary.

- The region has a lot of potential for success in the next ten years, with a growing pool of investors and talent attracted to the area, but there are also risks associated with growth and expansion.

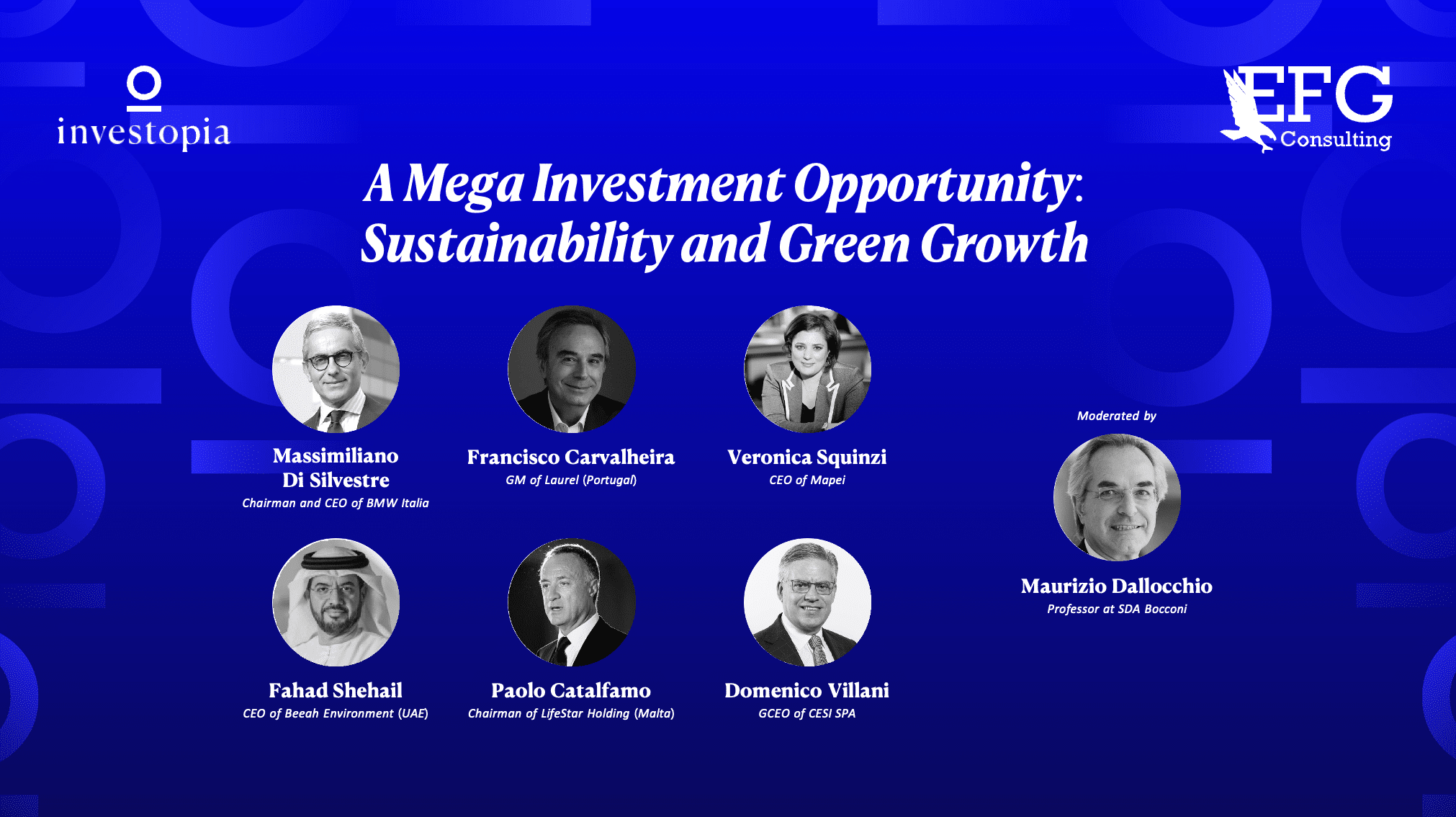

Investopia 2023 recently hosted a marketplace session titled “Good Failure vs. Bad Failure – a VC Perspective” featuring Amir Farha, Founder of COTU Ventures, Stephan Heller, Founding Partner of AQVC, and moderated by Dr. Tariq Bin Hendi, Senior Partner of Global Ventures in the United Arab Emirates. With 95% of all companies in the UAE being small and medium enterprises, this conversation on good and bad failures was crucial to understanding the economic outlook for 2023.

The discussion revolved around the differentiation between good and bad failures and how they impact the forward movement of the ecosystem. From a venture capitalist’s perspective, good failures happen in small increments and lead to innovation. These small mistakes are a sign that a startup is moving quickly and taking risks, which is crucial to success. On the other hand, bad failures disturb the ecosystem and create problems for everyone, such as fraud or a lack of execution and experience.

The panelists also discussed the importance of education in the VC world, both for investors and founders. For investors, education is necessary to understand the asset class and its capabilities. At the same time, for founders, sharing failures and experiences can lead to a recycling of knowledge that is beneficial for the ecosystem as a whole.

The conversation also touched on the cultural shift necessary in VC partnerships with founders, specifically the need to create a safe space for founders to voice their issues and for investors to nurture that trust. As Amir Farha noted, if founders fail, they should do so with dignity and learn from their experiences. The panelists also discussed the importance of hiring the right people at the beginning of a startup’s journey and focusing on core requirements rather than just pushing for valuation.

Looking ahead, the panelists identified potential areas of failure in the next couple of years, including systemic failure due to the lack of the right entrepreneurs or business model issues. The MENA region’s lack of funds and investment style was also identified as a challenge, with the need to create later-stage funds to build thriving ecosystems.

In conclusion, the conversation on good and bad failures from a VC perspective provided valuable insights into the importance of taking risks, learning from failures, and focusing on fundamentals rather than just pushing for valuation. With the proper education, partnerships, and cultural shift, the region can progress and succeed tremendously in the next ten years.