Investopia collaborates with experts and partners to provide valuable, actionable insights for leaders and investors on navigating new economies.

Our team and partners possess extensive knowledge and experience in identifying and capitalizing on new investment opportunities, as well as navigating diverse markets and regulatory landscapes. We share this expertise through our events and publications, empowering leaders and investors to make informed decisions and thrive in emerging economic landscapes.

The silver economy ensures that senior citizens continue to play an active role in the workforce and society. Where does the UAE stand in the space?

Digital transformation is projected to become a $2 trillion opportunity and has the potential to transform trade finance. The need to transform conventional processes into digital ones has never been greater, and technological improvements can help.

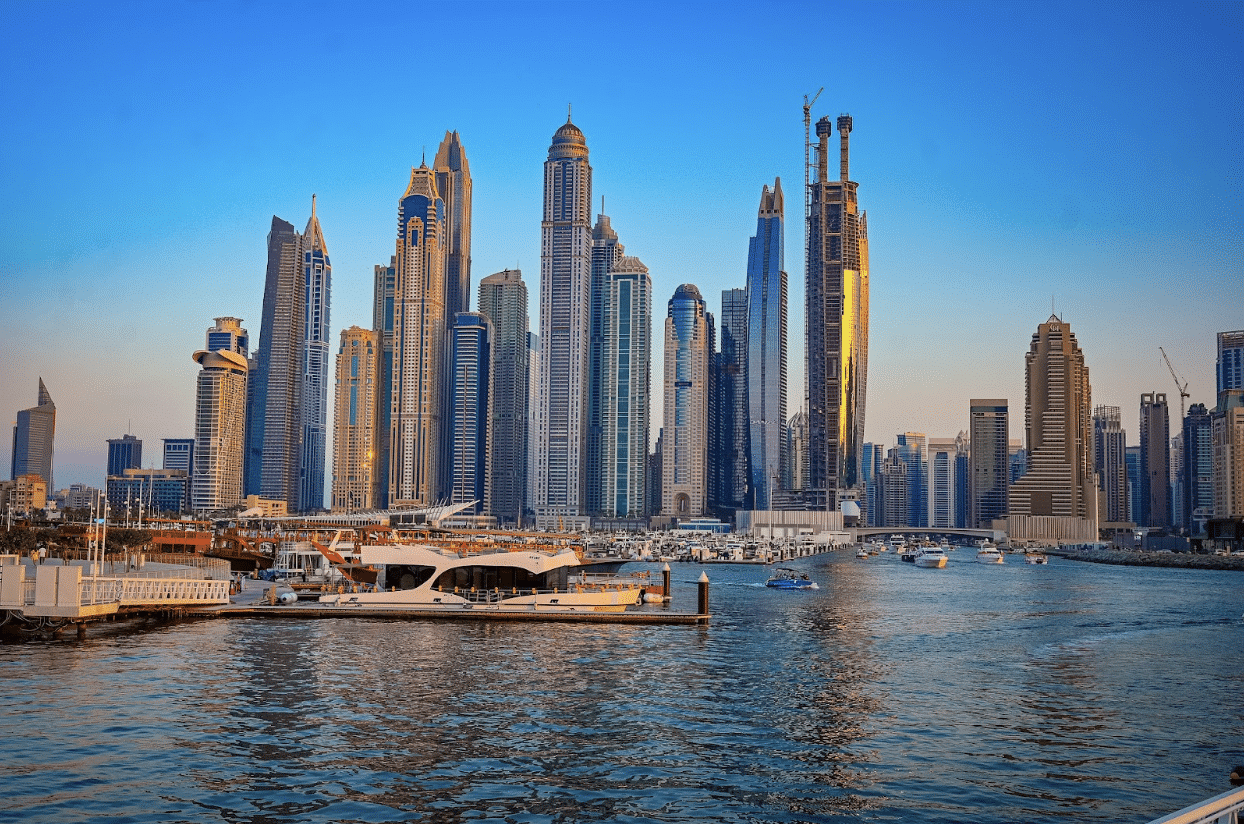

Investments in the UAE are increasing, and many national companies are actively cooperating with foreign partners. The UAE government has promoted several initiatives to boost economic growth, including the ‘Next50’ by Investopia.

The luxury investment landscape offers diverse opportunities, with classic cars and brand legacy standing out as lucrative sectors. Amidst a resilient global economy, luxury spending continues to rise, with cars and brands commanding significant sales. While the allure of luxury spans regions, particularly with the dominance of the United States and Asia, emerging markets hold untapped potential.

This session delved into the evolving strategies of family offices amidst a changing investment landscape. Discussions highlighted the growing importance of alternative assets, personalized investment approaches, and the institutionalization of family wealth management. Key themes included the shift towards diversified asset allocation, the impact of technology on investment strategies, and the need for a paradigm shift in mindset to navigate the complexities of modern wealth management successfully.

In this conversation, financial leaders discussed portfolio strategies and investment opportunities amidst rising geopolitical tensions and economic uncertainties. They touched upon global diversification, innovation in private markets, strategic partnerships, caution amid instability, and the importance of adaptability and resilience in navigating the complex economic landscape.

Get the latest investment news and insights delivered straight to your inbox.